Scammers using fake profiles of well-known celebrities are

scamming innocent fans out of thousands of pounds.

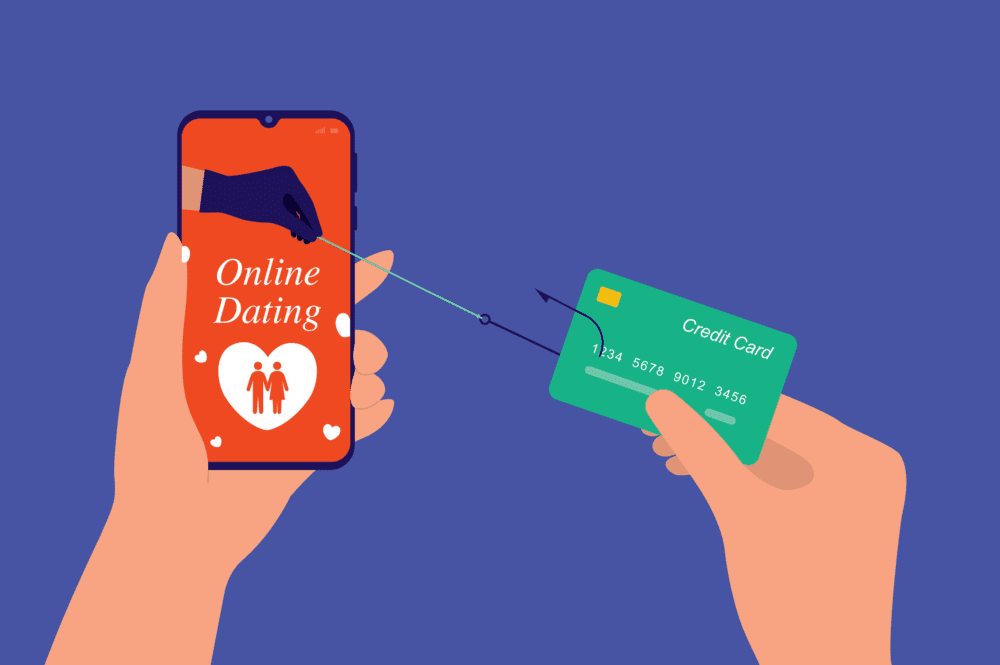

When looking for love or even just companionship online, being contacted by the star of your favourite TV show, or an international singing sensation, might seem like a dream come true. But with the proliferation of scammers impersonating celebrities to con victims out of thousands, it’s much more likely to turn into a nightmare!

Celebrity catfish

+ −Impersonating someone else online (aka catfishing) is a concept almost as old as the internet itself, and with the wealth of images, videos, and personal information about celebrities available online, it is increasingly easy for fraudsters to create and curate convincing profiles to deceive and lure in dedicated fans.

Often scammers will use the comment sections of posts on the celebrity’s verified social media profiles to find potential victims before striking up a conversation with them via private messages. These initially seemingly innocent conversations will quickly lead to requests for money.

Some recent examples of celebrity impersonation scams include:

- Outlander star Sam Heughan has had to release multiple warnings to fans after scammers pretending to be him, struck up a ‘relationship’ with a 56-year-old nurse and defrauded her out of £36,500 and others conned a woman who believed she was investing in the actor’s whiskey business out of £34,000.

- A superfan of Seal, the famous singer of ‘Kiss from a Rose’ and ‘Crazy’, lost £2,000 in a romance scam after a con artist claiming to be the singer, confided in her that he was bankrupt and needed her to pay a tariff to allow them to meet (despite the real Seal having a net worth of over £30million).

- ‘Helen’, a fan of British pop star George Ezra, who featured on MTV’s Catfish programme, recently told ITV’s This Morning that she was contacted by a profile claiming to be the singer after she commented on a fan club page on Facebook. She believed that she was in a genuine months-long online relationship with him before being asked to transfer £5,000 to fund a ‘meet- and greet’ with the celebrity.

These scams have the hallmarks of romance and impersonation scams, as the victim has already placed trust in the well-known figure being impersonated by the scammers. There are also a number of cases in which the ‘celebrity’ has convinced the victim to make payments into unregulated or non-existent investments, such as cryptocurrency.

Authorised Push Payment fraud

+ −Most celebrity impersonation scams are devised to convince victims, blinkered by the idea that they are speaking to their idol, to pay for what they believe are legitimate requests from the celebrity. This may include concert/event tickets, emergency medical care, or to help them get out of management contracts or obligations.

The scammers then manipulate the victims into sending funds via bank transfer, this is known as Authorised Push Payment (APP) fraud. In APP fraud, the payment is made by the victim willingly and is instantaneously transferred to the scammer’s account, at which point it is swiftly moved on. By the time the victim realises they have been scammed, the funds are extremely hard to trace, making it unlikely to recover anything.

Banks in the UK have a responsibility to keep their customers safe from fraud by putting in place procedures and sanctions such as:

- Monitoring accounts and transactions for signs of fraud, scams, and money laundering.

- Implementing systems to identify, delay and/or block suspicious transactions that could point to fraud.

- Following the City watchdog Financial Conduct Authority (FCA) guidance on how to protect consumers from fraud.

However, in some cases of APP fraud where banks had refused to refund victims, the case has been taken to the Financial Ombudsman Service (FOS) for an independent review. FOS is a Government backed body that deals with complaints between financial institutions and their customers. If they find fault with the banks, they also have the power to award compensation.

TLW Solicitor’s view

+ −Sarah Spruce, Head of the APP fraud team at TLW Solicitors comments:

“Fraudsters know that for a scam to succeed, they need to gain the trust of the victim, and how better to do that than pose as a well-known, much loved public figure? Unfortunately, the excitement of having the privilege to speak to – or even be in a ‘relationship’ with – a star, clouds judgement and can make it more difficult to spot red flags. If you, a friend or family member have been scammed in this way, there is no need to be embarrassed or ashamed, get in touch with our team as there may options available to help you get back on track.”

TLW Solicitors can help

+ −The dedicated APP fraud team at TLW Solicitors has a proven track record of dealing with the Financial Ombudsman Service on behalf of our clients. We work on a no-win, no-fee basis, so you will only be charged if your claim is successful.

The team will keep you up to date and informed with progress throughout your case, and treat every client with compassion and understanding. We understand the strict timescales and challenging processes involved in taking a claim to the FOS, and will work to get you the best possible outcome, so you know your case is in good hands. Get in touch for a confidential, no obligation consultation.

Call us on 0800 169 5925, email info@tlwsolicitors.co.uk or fill out one of the forms below.

It is important to get advice as soon as possible as strict time limits can apply.

Meet Our Team

Meet Sarah, who heads up our experienced Authorised Push Payment Fraud Claims team.

Sarah and her colleagues are on hand to help with your claim.