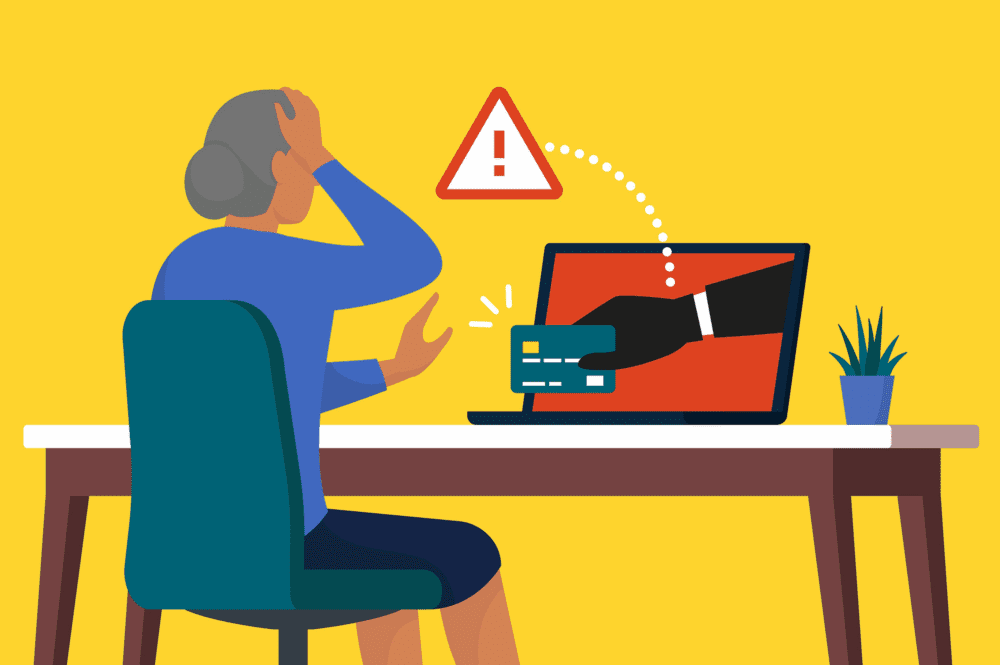

An unlucky jobseeker handed over almost £9000 in return for the promise of 'generous reimbursement'.

Mr K was looking online for employment and found what he believed to be a recruitment agency. They offered him a role as an affiliate marketer, writing product reviews in return for payment. However, the company insisted he hand over money upfront to access the online review platforms he would be working on and promised he would be generously reimbursed after writing the reviews.

Mr K made two payments on consecutive days, firstly for £5000 and latterly for £3850, using the Wise Payments Limited platform. He never received any payment from the employer and realised he had been scammed.

Mr K complained to Wise Payments and asked for his money back. Wise Payments refused and said that it was a ‘Money Remittance service’ and was not able to get involved in disputes between senders and recipients.

Who are Wise Payments Limited?

+ −Wise Payments Limited is an electronic money institution (EMI), offering personal and business money transfers across 160 countries in 40 currencies. According to its website, it is authorised as an EMI by the Financial Conduct Authority (FCA), the UK’s financial services and markets regulator.

Financial Ombudsman Service Investigation

+ −Mr K was unhappy with Wise Payments’ decision and took his complaint to the Financial Ombudsman Service (FOS). FOS is an independent body set up to sort out disputes between financial businesses and their customers. They look at complaints and aim to resolve them based on what is fair and reasonable, given the circumstances of the case and the regulations in place at the time.

An initial investigation by the FOS Investigator upheld Mr K’s complaint, however, Wise Payments argued against this, and the decision was reversed. The complaint was then escalated to an Ombudsman for final consideration.

Authorised Push Payment (APP) Fraud

+ −Authorised Push Payment Fraud is a type of fraud where victims are tricked into sending money, believing it is for a legitimate purpose. Usually, the payments are made using online banking and the Faster Payment System, where the money is transferred almost instantaneously.

In Mr K’s case, the recruitment agency was fake and the affiliate marketing vacancy did not exist. Mr K authorised Wise Payments Ltd to transfer the money to a scammer, not an employer, but didn’t realise there was a problem until he failed to receive any payment for the work he had done. Usually, scammers are one step ahead and have moved the money on to another account, making it extremely difficult to trace or recover.

Wise Payments was quick to deny any responsibility for Mr K’s loss, saying it simply followed his instructions, however, the Financial Conduct Authority (FCA) has confirmed that all e-money issuers “must comply with legal requirements to deter and detect financial crime, which includes money laundering and terrorist financing.” In other words, they should have policies and procedures in place – just as regular high street banks do – to ensure the appropriate checks are being carried out to prevent fraud and scams, such as:

- Monitoring accounts and payments made or received.

- Looking for unusual transactions, such as those of high value, a series of smaller payments, or new payees.

- Making additional checks before processing payments, or declining payments altogether.

The Ombudsman concluded that Wise Payments should have spotted the fraud risk in Mr K’s case and could have done more to prevent it. It should have known that the arrangement Mr K came to with his supposed employer was a common scam tactic and the large amounts he transferred were out of character compared to Mr K’s previous transaction history.

The Ombudsman also considered whether Mr K bore some responsibility for his loss and concluded that he should have acted more cautiously about the arrangement, questioning why he had to pay out nearly £9000 in order to get a job. Had he carried out more research in advance, he may have discovered that the recruitment agency was not a legitimate business. As such, the Ombudsman made a deduction of 50% from the compensation due to Mr K.

Mr K received 50% of the money he lost to the scam, plus an amount equivalent to 8% interest for the period between when he made the payments and when the compensation was paid out.

TLW Solicitors’ view

+ −Sarah Spruce, who heads up the experienced APP Fraud team, says:

“This decision highlights the fact that Electronic Money Institutions still have a duty to clients. They should have systems in place to identify the risk of fraud or scams and to protect their customers’ money. We work with people who have fallen victim to clever APP fraud, and they often can feel embarrassed or ashamed to admit they were conned in such a way.

However, there is help available to these victims and we urge anyone who has lost money through a financial scam to get in touch and talk about how we might be able to help them get their money back.”

Get in touch

+ −We work on a no-win, no-fee basis and have extensive experience of APP fraud refund claims, including dealing with the rapidly increasing number of employment and recruitment scams as happened in Mr K’s case.

If you, a friend or a loved one are the victim of an APP fraud scam, please get in touch with TLW Solicitors. Call 0191 293 1500, email us at info@tlwsolicitors.co.uk or complete one of the callback forms below.

It is important to get advice as soon as possible as strict time limits can apply.

Minimum case values apply.

Meet Our Team

Meet Sarah, who heads up our experienced Authorised Push Payment Fraud Claims team.

Sarah and her colleagues are on hand to help with your claim.