A new analysis from workplace pension provider People’s Partnership predicts that savers could lose £1.2 billion a year due to poor pension transfer advice.

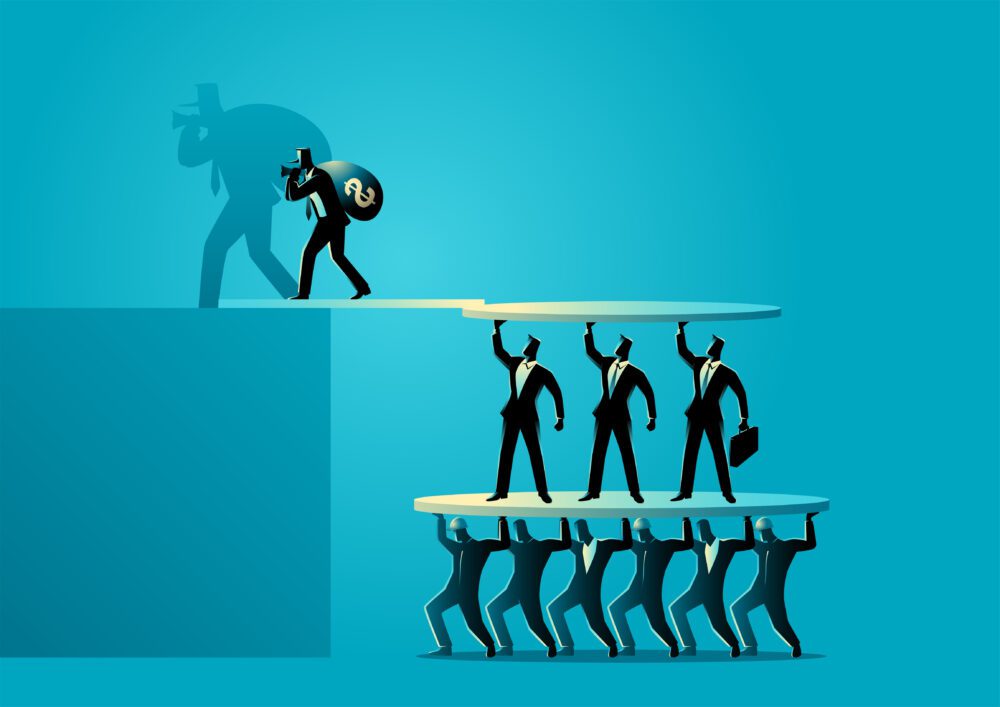

People’s Partnership, the firm behind The People’s Pension, has published new insights into the workplace pension transfer market. Their analysis estimates that around £1.2 billion might be lost in just one year, due to non-existent or poor pension transfer advice that leads to savers moving their workplace pensions into higher-charging pensions.

Defined Contribution Pension Schemes

+ −Many workplace pensions are Defined Contribution (DC) pensions. Pension contributions are usually deducted from your salary before it is taxed, and the pension provider invests the money. With a workplace pension, the employer also pays into the fund, usually a percentage of your earnings. At the end of your working life, the pension pot will have a certain value, depending on how the investments have performed over the years and how much has been paid in fees and charges.

Latest pension transfer outcomes research

+ −The Pension Transfer Outcomes Index research found that:

- 72% of people who had transferred a DC pension in the past two years didn’t know what they were paying in fees.

- 10% of people who had transferred a DC pension believed (incorrectly) they were paying no fees.

- Market activity for unadvised DC transfer has increased by more than 50% in four years.

- Individuals who transferred from lower-charging workplace pensions (charging 0.4%) to higher-charging retail pensions (charging 0.8%) could have 20% less in their pension pot at retirement age and need to work another three years to make up the shortfall.

People’s Partnership is, not surprisingly, calling for pension providers to be much better at giving key information to savers, including ongoing fees and charges. CEO Patrick Heath-Lay said:

“The FCA has a new value for money framework for workplace pension schemes high on its agenda. We believe this framework should apply to the whole market, rather than just workplace pensions.”

Certainly, value for money is one of the key considerations savers should look at in detail when considering moving or consolidating pension funds.

Pension Mis-Selling Claims

+ −Pension Mis-Selling Claims

The data highlighted by People’s Partnership talks about ‘ill-informed’ pension transfers but does not distinguish between people who received no financial advice before moving their funds and those who received poor or inappropriate financial advice.

Many cases of pension mis-selling succeed because a financial adviser is negligent in assessing an investor’s attitude to risk, the type of funds they should invest in, or the fees and charges associated with the proposed funds.

It stands to reason that, if you transfer from a pension with lower charges, to one with higher charges, the fund will have to perform better to compensate for the increased fees, but this is not always clearly set out at the advice stage.

TLW Solicitors can help

+ −People who have been advised to transfer pensions without knowing the risks, and have lost out financially, may be entitled to compensation. Our specialist team can work with you to make a claim and get back the money that you have lost.

Sarah Spruce, Legal Director and Head of the Pensions Mis-Selling team at TLW Solicitors, says:

“The People’s Pension states they have a 25% market share in workplace Defined Contribution pensions, so they are well placed to predict what might be lost through ill-advised pension transfers. Given how long we spend working and saving for our retirement, it pays to get good, independent financial advice before moving a pension fund, as even a small difference in annual fees can have a huge impact on what your fund might be worth.

“If you feel you have not received the right advice, please contact my team for a confidential, no-obligation discussion about next steps. We can explore whether you may have the basis of a ‘no-win, no-fee’ refund claim.”

Get in touch

+ −If you or a loved one have moved or consolidated pension pots, received unsuitable financial advice or are worried about increased fees and feel you have lost out, then get in touch with the team at TLW Solicitors for a no-obligation conversation about making a possible compensation claim.

You can call us on 0191 293 1500, email info@tlwsolicitors.co.uk or use one of the contact forms below.

Time limits can apply, and so anyone wishing to bring a claim should do so without delay.

Minimum claim values apply.

Meet our Team

Meet Sarah, who heads up our experienced Pension Claims team.

Sarah and her colleagues are on hand to help with your claim.