A number of Revolut customers have taken their unauthorised transaction fraud complaints to the Financial Ombudsman Service for resolution.

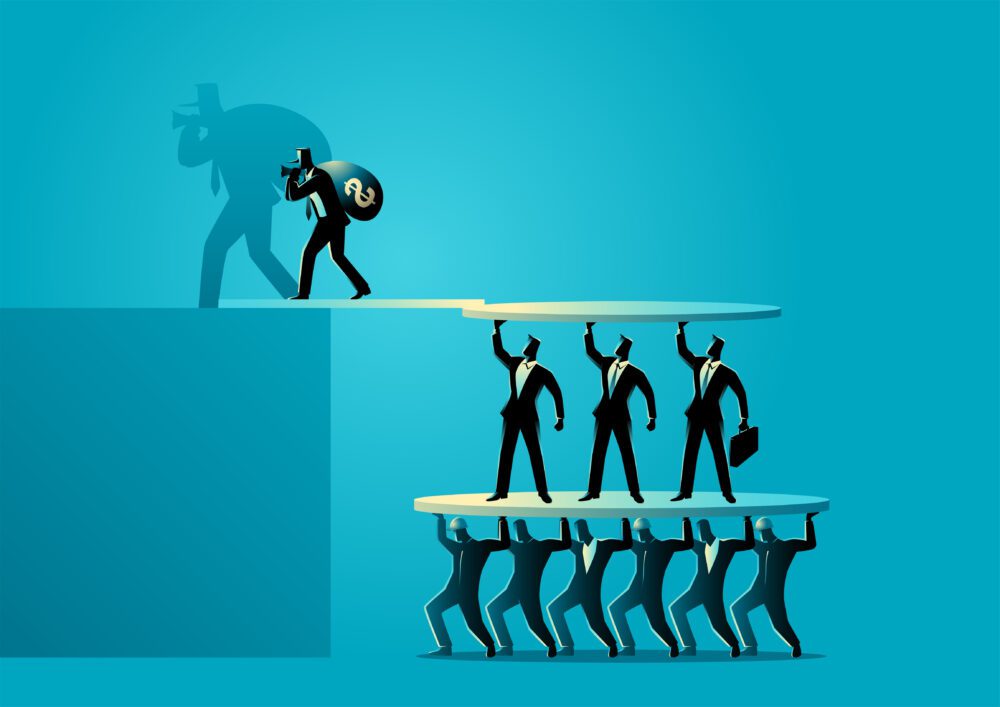

People lose money through two main types of fraud – authorised push payment (APP) fraud and unauthorised transaction fraud.

Authorised push payment fraud often happens due to impersonation, where someone contacts you out of the blue, pretending to be another person, business or organisation. Fake companies, spoofed phone numbers and cloned websites can all trick people into thinking they are dealing with someone genuine. APP fraud victims are tricked into authorising transactions from their bank account using the Faster Payments System, leading to financial loss.

Historically, banks were keen to push the blame onto their customers, saying they were liable for any losses because they authorised the payments.

Unauthorised transaction fraud can also happen as a result of impersonation. The scammer pretends to be a trusted individual, such as a bank official, and uses deception to gain access to your bank account. They usually take money or buy goods without your permission or authorisation. They may even take out loans in your name or use an overdraft facility. Once you notify your bank of any unauthorised transactions on your account, you will not be liable for any further losses – unless the bank believes you were grossly negligent or acted fraudulently.

In both scenarios, there are procedures to follow: it is important to report any fraud to your bank, the police and Action Fraud, the national fraud and cybercrime reporting centre. They should investigate, and you may get your money back. If they don’t, or you disagree with their decision, you can take your complaint to the Financial Ombudsman Service (FOS). FOS is an independent government-backed body responsible for resolving disputes between financial businesses and their customers.

Not the first time we have discussed Revolut, the following four cases involve customers taking complaints to FOS after the online bank refused to refund money lost through unauthorised transaction scams.

Mr and Mrs B, directors of Company B

+ −Mr B received a phone call from someone claiming to be from Revolut’s fraud team. He was told there had been fraudulent activity on the company bank account and that he needed to help secure the account. Mr B recalls seeing money leave his account but was told it was part of the security procedure and would be returned. He also recalled setting up a virtual card as the original bank card had been frozen. Mr B’s company lost £28,600 in around 15 minutes.

Once Mr B realised the caller was a scammer, he contacted Revolut for help getting his money back. They refused to refund any money, saying Mr B had authorised the payments using Apple Pay and One-Time Passcodes. He took his complaint to the Financial Ombudsman Service (FOS).

A FOS Investigator initially upheld Mr B’s complaint, but Revolut disagreed, and the case was escalated to an Ombudsman for a final decision. The case hinged around whether or not Mr B had been tricked into sharing sensitive information, allowing the scammer to set up Apple Pay on their own device and take B’s money without authorisation. He believed he was helping prevent fraud on his account and not, in fact, facilitating fraud.

FOS concluded that company B could not be fairly held liable for the money lost from its bank account and these were unauthorised transactions. The money was refunded in full, plus 8% interest as compensation.

Mr L, director of Company M

+ −Mr L received a phone from someone claiming to be from Revolut. He was told that there had been an attempt to access the company bank account and that he could get online help from the Support team. Mr L didn’t realise he was giving a scammer remote access to his desktop computer. He shared a code with the caller, which he was told would be used to release the funds someone had tried to steal and to unblock the account. In fact, the fraudster on the other end of the phone used the code to take £10,800 from the account and then disappeared.

Mr L reported the loss to Revolut, who initially refused to refund the money, then offered half as a goodwill gesture. Mr L was still unhappy with the outcome and asked FOS to investigate.

An Ombudsman considered whether or not Mr L had authorised the £10,800 payment. They concluded that Mr L was tricked into giving the scammer remote access to his computer and that he didn’t play a part in transferring the money out of the company’s bank account. It was, in effect, an unauthorised transaction made by the scammer and there was no reason why company M should not be refunded in full. 8% interest was also added as compensation.

Mrs H

+ −Mrs H held a personal bank account with Revolut and was contacted by someone purporting to be from the bank about suspicious activity on her account. Believing the caller to be genuine, she assisted them in carrying out a series of steps to ‘protect’ her money. She didn’t realise that the caller was a scammer who had tricked her into sharing a one-time passcode (OTP) that allowed Apple Pay to be set up on another device under the scammer’s control.

A total of £11,700 was taken from her account before she realised she had been scammed. On contacting Revolut to complain about the scam, Mrs H was told that she was liable for her losses, as she shared the OTP allowing the fraudster to access her account.

Not happy with Revolut’s response, Mrs H took her case to the Financial Ombudsman Service for an independent investigation. FOS agreed with Mrs H, saying that the scammer had pressured her to share information and that she genuinely believed she was helping secure her compromised account. FOS added that Mrs H had not acted negligently when sharing the one-time passcode and should not be held liable for her losses. Revolut was ordered to pay Mrs H £11,750 plus 8% simple interest as compensation.

Ms N

+ −Ms N held a bank account with Barclays. She was contacted by someone claiming to be from her bank, saying a standing order had been set up on her account. She was provided with a telephone number in case of any issue. She called the number and spoke to a person who knew her account number and sort code, as well as her name and address. Ms N believed she was talking to someone from Barclays and that they would help protect her from fraud.

She was then told to open a Revolut account and led to believe that Revolut was part of Barclays. Ms N was asked to move money into the new Revolut account and share One-Time Passcodes. The caller told her that they would be testing the security of her account by attempting transactions but that her money would be safe. She was also asked to unblock her card at one point.

Ms N realised she had been scammed after speaking to a genuine Barclays employee. She lost over £800 from the newly set up Revolut account and contacted Revolut about getting her money back. Revolut refused to refund any money, saying that Ms N had authenticated the payments through Apple Pay, and was grossly negligent.

Ms N was unhappy with Revolut’s decision and took her complaint to FOS. The Ombudsman concluded that Ms N was not liable for her financial losses, as she had been heavily coached by the fraudster and was not fully aware of what the OTP would be used for (setting up Apple Pay on another device). The payments were unauthorised transactions and she should be refunded in full, plus 8% simple interest.

Claiming compensation for unauthorised transaction fraud

+ −These case examples highlight different tactics scammers use to get their hands on your money. If you find yourself in a similar position, ensure you report the crime to your bank and ask for a refund.

The Financial Ombudsman Service (FOS) conducts wide-ranging investigations into both authorised and unauthorised fraud and has ruled in favour of many customers who have fallen victim to impersonation scams.

TLW Solicitors can help: our team of legal specialists understand the FOS claims and appeals processes, the timeline to be followed and the information needed. If you want us to help you pursue your claim, simplify what can be complex legal and financial jargon, and get you the best possible results, please get in touch.

Contact us for a free, no-obligation review of your case

+ −We will review your case and decide if we feel it is suitable to progress. If it is, we work on a no-win, no-fee basis, meaning that if your case is unsuccessful, we will not charge for the time we have spent on it.

If you, a friend, or a relative has lost money through unauthorised activity on your bank account, please contact our specialist team for a confidential, no-obligation conversation

Telephone 0191 293 1500, email info@tlwsolicitors.co.uk, or complete one of the forms below.

It is important to get advice as soon as possible, as strict time limits can apply.

Minimum claim values apply.

Meet Our Team

Meet Sarah, Legal Director at TLW Solicitors.

Sarah and her colleagues are on hand to help with your claim.