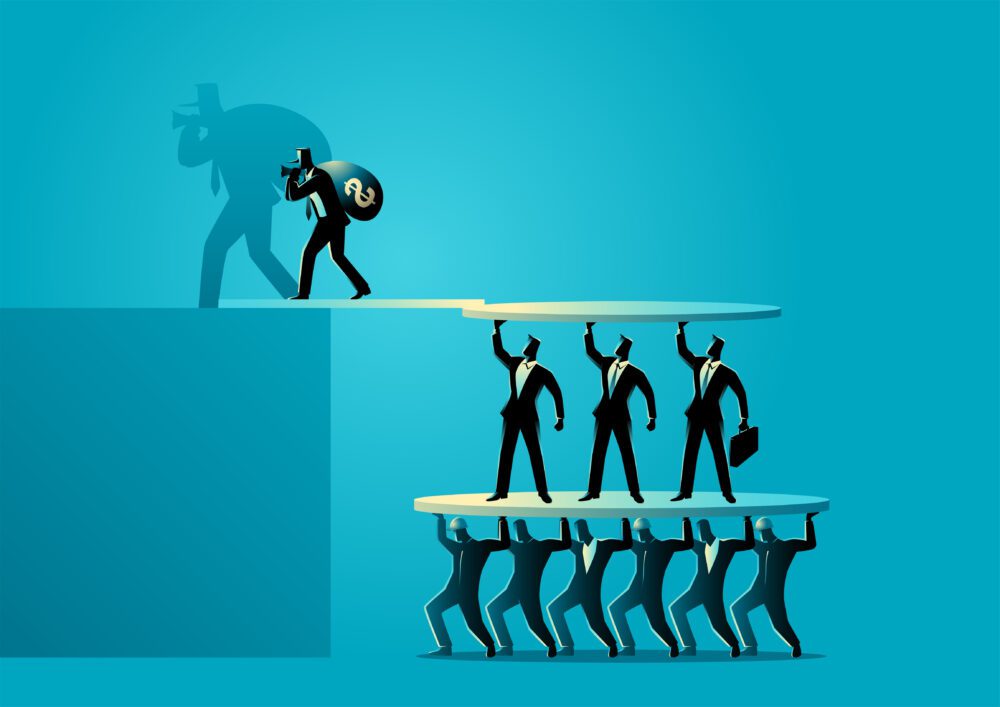

Guy Flintham pretended to be a successful trader, taking £19 million from unsuspecting investors, including friends and family. He used some of the money to pay for his lavish lifestyle.

A judge at Southwark Crown Court has handed down a six-year sentence to Guy Flintham, a Lancashire-based “trader” who ran an investment scheme between 2016 and 2021. Mr Flintham claimed to be a successful trader, convincing over 240 investors to part with significant sums of money over the 5-year period.

The Financial Conduct Authority (FCA), the UK’s financial services watchdog, brought the fraud prosecution against Mr Flintham, after learning about the money lost by investors in what was effectively a Ponzi Scheme.

What is a Ponzi Scheme?

+ −A Ponzi scheme is a fake investment promising high rates of return where unsuspecting investors usually find that their money was never invested as intended, or at all, and that any ‘returns’ came from other investors’ capital. This type of scheme is destined to fail, and the fraudsters usually disappear with whatever money is left.

In the case of Guy Flintham, the FCA claimed he:

- Placed only £1.14 million into trading accounts

- Used £10 million to pay back investors as ‘profits’ or withdrawal of cash

- Sent his victims falsified trading statements showing good returns

- Spent over £1 million funding an extravagant lifestyle with vehicles, jewellery and designer goods

The Crown Court Judge, HHJ Milne, said at sentencing:

“People were devastated by what has happened; people’s lives have been irrevocably damaged.”

Ponzi Schemes and Authorised Push Payment Fraud

+ −Authorised Push Payment Fraud (APP Fraud) happens when people are tricked into transferring funds from their bank account directly to the scammer’s account. By getting the account holder to authorise the payment, many of the bank’s online security measures are easily bypassed, and the money is transferred almost immediately.

Scammers, including those running some Ponzi schemes, which is a type of investment scam, are skilled at using persuasive language and clever social engineering tactics to coach their victims and avoid suspicion. Once the money has been transferred, the scammer quickly moves it to another account, often overseas, making it difficult to trace or recover.

Many banks have tried to push all the blame onto their customers for losing money in this way, arguing that they ‘authorised’ the payment, so it is their fault their money has gone. However, in recent years, there have been an increasing number of cases where the bank has been found responsible for the loss. Banks are considered financial security experts and should know more about fraud and scams than the general public. Their procedures and processes should be rigorous enough to detect fraud attempts and be able to put a stop to them before any of their customers’ money is lost.

What checks can I do before investing online?

+ −It is important to carry out rigorous checks before investing online. If necessary, take advice from an Independent Financial Adviser (IFA) listed by the Financial Conduct Authority on their Financial Services Register. Double-check any website addresses, contact details and bank account information in case there are clone firms operating with the same or a similar name.

Be wary of investing simply because friends and family are; it still pays to do your homework. Mr Flintham’s family and friends trusted him but were left devastated, both financially and emotionally.

Remember, if an investment scheme seems too good to be true, it probably is!

Have you lost money to a Ponzi scheme or APP Fraud?

+ −If you discover that you have been the victim of an Authorised Push Payment investment scam, the first step is to contact your bank and Action Fraud, the national fraud and cybercrime reporting centre. Your bank should investigate and try to recover your money.

If the money cannot be recovered, the bank does not accept your claim, or if you disagree with their decision, you can make a complaint to the Financial Ombudsman Service (FOS). FOS is an independent, government-backed service that settles disputes between financial businesses and their customers.

TLW Solicitors - APP Fraud Claims Specialists

+ −We have a team of specialist lawyers who regularly deal with investment scams. Our experienced, responsive and empathetic team know the timescales involved and the information required to make a successful claim, keeping clients up to date at every step of the way.

Submit your claim and we will undertake a no-obligation review of your case. If we feel your claim is one that we can deal with, we will work on a ‘no-win, no-fee’ basis, meaning that if your refund claim is unsuccessful, you will not have to pay us for the time we have spent working on it.

Legal Director and Head of TLW’s APP Fraud department, Sarah Spruce, says:

“Losing a large chunk of your life savings can have a devastating impact. We are speaking to people just like those who lost money in Mr Flintham’s investment scheme. They tell us they worry about not having enough money for their retirement and that they feel embarrassed they were tricked into investing in the first place.

I would urge anyone who has fallen prey to a clever fraudster to come forward. Don’t be ashamed; practical support is out there. Our experienced team can explore your options and see if we can help by making a ‘no win, no fee’ refund claim.”

Get in touch today

+ −If you or someone you know has been the victim of an investment APP scam, contact our team today for a confidential, no-obligation conversation.

You can call us on 0191 293 1500, email info@tlwsolicitors.co.uk or complete either the make a claim online or callback forms below.

It is important to get advice as soon as possible, as strict time limits can apply.

Minimum case values apply.

Meet Our Team

Meet Sarah, who heads up our experienced Authorised Push Payment Fraud Claims team.

Sarah and her colleagues are on hand to help with your claim.