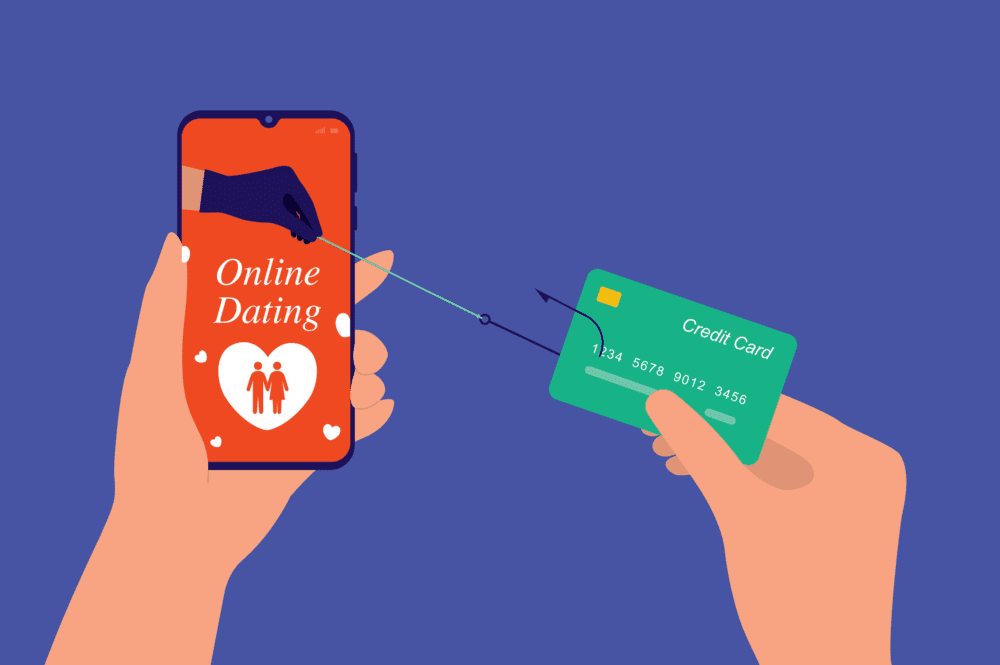

Unsuspecting victims are being conned out of millions in sophisticated fraud designed to tug on their heartstrings. Can you spot the signs of a scam and keep your money safe?

They say love hurts, and nothing hurts more than falling victim to a romance scam. This type of fraud is becoming increasingly sophisticated and costs Britons millions every year.

Data from the National Fraud Intelligence Bureau, run by the City of London Police, suggests almost £95 million was lost to romance fraud in a 12-month period to June 2024. However, this may not reflect the complete picture, as many people are too embarrassed or ashamed to report their financial losses. This type of crime shows no signs of slowing down in 2025, with McAfee uncovering 6000 links to romance scams in the run up to Valentine’s Day.

What is a Romance Scam?

+ −Romance scams are a type of Authorised Push Payment Fraud (APP Fraud). People meet online, build a seemingly genuine romantic relationship, only to discover that they are being manipulated and asked to transfer money, often for travel or health emergencies.

Repeated requests for money follow – accompanied by tales of financial difficulty. A common theme in these cases is that the two parties have never met face to face. The victim may become suspicious, or no longer be able to pay out, and the scammer disappears, taking the money with them.

Once a romance scam has been detected, it can be challenging to recover lost funds, as the scammer has cleverly moved the money on to an unknown bank account, sometimes overseas, making it virtually untraceable.

What are the typical red flags of a Romance Scam?

+ −Did you know that males aged 20-29 and females aged 50-59 are the most at risk of romance scams? However, anyone can be targeted and there are several red flags to be aware of, so you can keep yourself and your money safe:

- Fraudulent online dating or social media profiles, containing limited information and using someone else’s profile image – carry out a ‘reverse image search’ if necessary

- Being asked to take the conversation off a dating app onto another messaging service, to avoid the app’s built-in safety checks

- Early declarations of love and affection, called ‘love bombing’, which more vulnerable people are more susceptible to

- Avoiding face-to-face meetings or video chat

- Requests to send money, often with a sense of urgency, from someone you’ve only just connected with

- Requests to open a bank account or take out a loan on behalf of the other person, or to share personal identification documents (such as passport or driving licence)

I was scammed – how do I get my money back?

+ −If you have fallen victim to a romance scammer, you are not alone. Thousands of people are conned every year by this type of sophisticated fraud. If you think you’re the victim of a romance scam – URGENTLY report the crime to your bank, the police and Action Fraud, the National Fraud and Cyber Crime Reporting Centre.

Your bank should carry out an investigation and try to recover the money you have lost. If that is not possible, or you do not agree with the bank’s investigation, you may take your case to the Financial Ombudsman Service (FOS). FOS is an independent, government-backed body, set up over 20 years ago to settle disputes between financial institutions and their customers.

In recent years, the onus has fallen on banks to keep their customers’ money safe and protect them from financial harm. This led to a change in the law in October 2024, meaning banks must investigate and reimburse eligible APP fraud victims within 5 working days.

While these changes are welcome and designed to help victims get their money back more quickly, many cases fall outside the new regulations. That’s why it is worth getting in touch and asking us to investigate whether you can make a claim directly to the Financial Ombudsman Service.

TLW Solicitors’ point of view

+ −Sarah Spruce, Legal Director at TLW Solicitors, says:

“You may have seen articles in the news about people being scammed by ‘Brad Pitt’ or ‘George Clooney’ and thought, “I’d never fall for that!” But these are the exceptions rather than the rule. Most romance scammers pretend to be normal people, with average looks and jobs. That way, they blend in with others on your ‘match’ list and are believable. It’s not surprising that people get caught out. Learn to spot the red flags highlighted above, and hopefully you will meet Mr or Ms Right.

If you or a loved one have fallen prey to a romance scammer – don’t be ashamed or embarrassed, as these stats show, anyone can fall victim. My team regularly helps clients who have lost money to the scammers, and this is not something that you have to deal with on your own. Get in touch for a confidential, no obligation discussion and we can explore your options, including whether you may be able to make a ‘no-win, no-fee’ refund claim.”

Financial Ombudsman Service (FOS) claims

+ −FOS operates a two-tier investigation process: an Investigator looks at all the evidence and decides if the financial institution is at fault and compensation should be paid. If either party does not accept their view, an Ombudsman can review the case and reach their own independent decision. Their decision is final and can result in an award of compensation for financial loss and distress/inconvenience.

FOS claims can be complicated and time-consuming. The claims and appeals processes involve information-gathering and presenting an argument to FOS, outlining why you think you are entitled to compensation. Our specialist APP Fraud team has the skills you need to navigate these processes. We understand the legal and financial jargon, so if you don’t have the time or knowledge to pursue your claim, let us help.

TLW Solicitors are APP Fraud claims specialists

+ −We’re here to help you on a ‘no-win, no-fee’ basis, and we’ll take a close look at your case to see if your claim has a good chance of succeeding. If you qualify, we’ll send you a welcome pack filled with all the information you’ll need to move forward with your refund claim.

Your dedicated case handler will gather and review all the necessary documents, keeping you updated every step of the way. If you have any questions at all, just contact us by phone or email – we’re always here for you! And remember, if your claim doesn’t succeed, you won’t have to pay for the time we’ve invested in helping you.

Get in touch

+ −If you, your friend or a relative have been conned into making payments to fraudsters through a romance scam or other online APP fraud, please contact our specialist team for a confidential, no-obligation conversation. You can call us on 0191 293 1500, email info@tlwsolicitors.co.uk or complete one of the forms below.

It is important to get advice as soon as possible, as strict time limits can apply.

Meet The Team

Meet Sarah, Legal Director at TLW Solicitors.

Sarah and her colleagues are on hand to help with your claim.